Read this if you are concerned about cybersecurity.

A glance at the current cybersecurity landscape

Cybersecurity has become a priority for organizations of all types. From small to large businesses, and government agencies to non-profits, leaders must consider an increasing number of cyber threats, risks, and vulnerabilities. The cost of handling a cyber incident can be alarming, and so nearly every cybersecurity-related decision must be measured against its effect on the organization’s cyber risk profile.

Many leaders manage cyber threats by implementing the best controls and systems their budget will allow in order to mitigate cyber risks and improve their overall cybersecurity posture—this is wise. But regardless of how diligent an organization is, there is always the possibility that a zero-day vulnerability is exploited by a threat actor or that an employee falls victim to a social engineering attack.

.png)

Unaddressed gaps in an organization’s cybersecurity controls—which have become increasingly evident during the COVID-19 pandemic—are making it easier for threat actors to target and carry out cyberattacks. These attacks are increasing in frequency and complexity and organizations of all sizes in all industries are being targeted.

Instead of accepting the potential financial risks associated with cyberattacks, many organizations are beginning to consider a more pragmatic approach, similarly to how they address other organizational risks and uncertainties: they transfer some of the financial risk to an insurance company (at a cost of course). In the event of a cyberattack reputational or operational risk still resides within the organization, it can be helpful to use cybersecurity insurance to help with the financial impacts of cyberattacks.

What is cybersecurity insurance and why is it important?

Cybersecurity insurance, also called cyber insurance or cyber liability insurance, is a type of insurance policy that provides organizations with a combination of coverage options to help protect against the financial losses caused by cyber incidents like data breaches, ransomware, and other cyberattacks. Cybersecurity insurance coverage works just like other insurance policies that cover financial losses in the event of physical risks and natural disasters.

Cybersecurity insurance policies can cover financial costs associated with legal fees and expenses, notifying customers about a data breach, restoring personal identities of affected customers, recovering compromised data, repairing damaged computer systems, as well as other potential costs. Financial assistance with notification to those impacted by a breach is getting increasingly more important because more and more states are requiring organizations to notify customers of a data breach involving personally identifiable information (PII) in a timely manner—a process that has proven to be very expensive. For example, the California Consumer Privacy Act (CCPA) requires organizations to notify all California residents who were affected by a data breach without unreasonable delay. Other states have enacted similar requirements.

A cybersecurity insurance policy can be a valuable component of an organization’s cyber risk management program, as it is designed to improve the organization’s cyber risk profile—at least in terms of financial risk. However, a cybersecurity insurance policy should only be considered after an effective cybersecurity strategy, with sufficient cybersecurity controls in place, has been implemented. In other words, cybersecurity insurance should complement an organization’s existing cybersecurity processes and technologies to help reduce the financial burden of a potential cyberattack, but it should not be the only strategy that is implemented by an organization.

Who should buy cybersecurity insurance?

All organizations that create, store, and manage electronic data online, such as PII, protected health information (PHI), and personally identifiable financial information (PIFI), can benefit from cybersecurity insurance; however, enterprise risk management drives cybersecurity decisions, and that includes whether to purchase cybersecurity insurance or not.

Due to the increasing number of cyberattacks over the last few years, the cybersecurity insurance market is evolving and becoming more complex, and many organizations are choosing to forgo this type of insurance because of increasing costs. In the United States, the Cybersecurity and Infrastructure Security Agency (CISA) is encouraging organizations to focus on improving their cybersecurity controls first, in order to receive cybersecurity insurance coverage at more affordable rates.

Even before the COVID-19 pandemic, insurance companies had been tightening requirements for coverage and asking for more evidence that organizations are doing their due diligence to mitigate against cyberattacks. Whether it is detailing backup procedures or answering questions on specific security controls or systems in place, organizations looking for cybersecurity insurance can expect a more rigorous underwriting process going forward—the days of simple questionnaires are over.

How to lower cybersecurity insurance costs

Fortunately, for organizations interested in purchasing cybersecurity insurance, there are ways to decrease premium costs. This includes implementing strong identity security controls and following industry best practices to protect against phishing and credential theft, ransomware, data breaches, and other cyber risks. More specifically, this includes implementing a robust cybersecurity strategy comprised of layered security controls. Examples of cybersecurity controls and best practices that insurance companies look for are included in the table below. By demonstrating that these controls are implemented and best practices are followed, an organization can significantly reduce their cybersecurity insurance premiums.

.png)

Conclusion

Organizations can accept the risk of financial loss from a cyberattack, avoid risky endeavors, implement cybersecurity controls and systems, and adhere to industry best practices, but some risk of a cyberattack will remain.

The most important step an organization can take to help prevent cybersecurity attacks or mitigate the impact of a cyber incident is to focus on improving cybersecurity controls, processes, and technologies. By doing so, the organization is not only reducing potential risks, but also positioning itself to purchase cybersecurity insurance coverage at more affordable rates. While each insurance company’s evaluation process varies, there are certain security controls that are almost always required for an organization to acquire cybersecurity insurance coverage. This often involves Identity and Access Management (IAM) controls and best practices in alignment with industry standards put forth by the Center for Internet Security (CIS), CISA, and others.

For organizations looking to address the financial costs associated with cyber risk, they should look to an insurance company to understand if the cost of insurance and coverage received would complement their existing cybersecurity risk management program. However, in the event of a cyberattack, it is critical the organization understands that other risks such as reputational and operational risk will always remain, regardless of the insurance coverage.

If your organization is interested in purchasing cybersecurity insurance, the following link provides more information and general tips on what your cybersecurity insurance policy should include: Cyber Insurance | Federal Trade Commission.

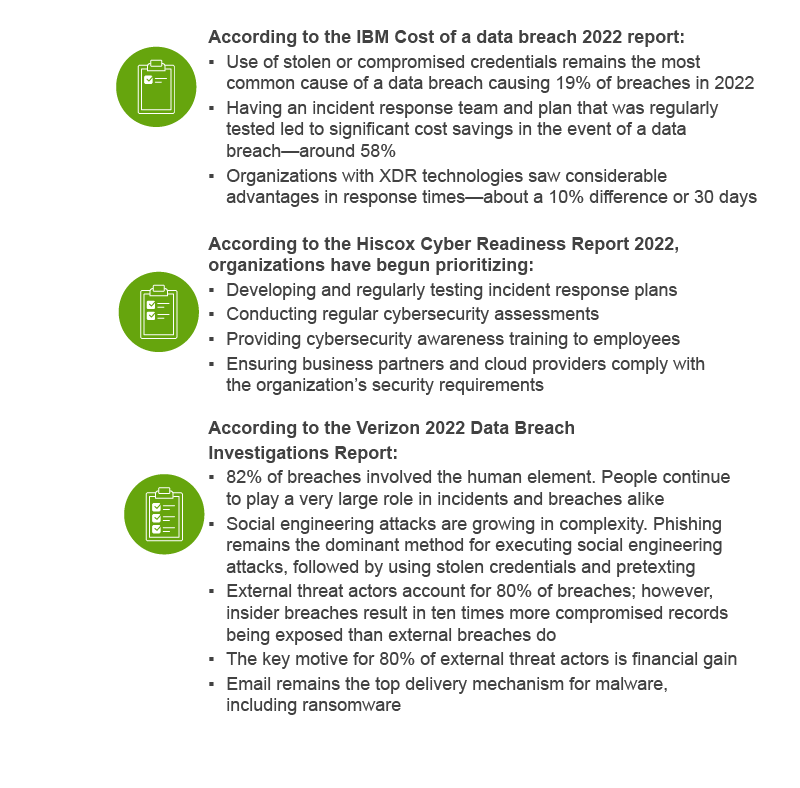

Below are some helpful takeaways from recent breach reports to consider:

Sources:

Cyber Readiness Report 2022 | Hiscox

Cost of a data breach 2022 | IBM

2022 Data Breach Investigations Report | Verizon