Read this if you are a business owner.

While recent articles within the exit planning community have noted a slowing of business transitions and exits, during times of uncertainty it may be even more important to focus on the opportunity at hand. Rather than waiting it out, we recommend that business owners try to be active, involved, and focus their efforts on improving their business.

The situation is similar to the ebb and flow of the tide. The current economy is the tide at an extreme low point. We know that the economy will recover, so what can be done in the meantime to take advantage of opportunities, and be ready to succeed when the tide rises?

Changing of tides

Suddenly, there has been a rapid and seismic shift in the landscape. Weaknesses and threats, rocks and hazards, may have emerged. How you choose to approach these perils will make a difference in the long term. Will you take the opportunity to discover, identify, assess, shore up, and mitigate these elements?

It is important to view this current state in the context of the larger, long-term perspective. Once the tide comes back, will you be able to set full sail ahead having built resiliency, redundancy, and strength into those areas while you had the opportunity? While the water is low, it presents a great opportunity for business owners to discover and understand:

- What broke first and why?

- How can you shore it up for better operations in the days ahead?

- What weak spots you didn’t know about are now apparent?

- How can you address those weaknesses?

- How can you leverage existing resources differently to chart a path forward?

Models of priority

There are various stages or hierarchies of priority in thinking about the progress of a business.

Each priority model features bases and pinnacles. The pinnacles of each model are realized in a long-term setting, after the remaining bases have been solidified. While continued development of a clear vision for your business is paramount, dynamic shifts in the landscape call for reassessment of the bases. In the long-term, self-fulfillment manifests from properly executed strategy, but in the near- and mid-term, these various frameworks force strategic planning back to assess and address the base components.

The bases of each model should serve as safe havens for reversion. When facing uncertainty and failure, have you made your base strong enough to redirect your efforts in an actionable plan for the long-term?

Action Planning Pyramid and Value Maturity Index

The Value Maturity Index, broken into five stages is a stepwise assessment of active exit and business strategy. Inherent in the value acceleration framework are the concepts of resiliency, redundancy, disaster recover, and actionable planning.

While we may have been fully entrenched in the build phase, setbacks due to dynamic changes in the landscape force us back to protect mode—the assessment and methodical shoring up of weaker points of the operation to protect against future downside risks.

Though this stepwise progression is linear in nature, keep in mind that flexibility and adaptability are paramount in changing course to address needs of your current state.

When we look at action planning, parallels can be drawn to the various models. Certainly, we are focused on continuing sales, marketing, and customer relationships, but it becomes a question of reversion to meeting the basic needs and serving client’s pain points rather than beginning ground-breaking efforts.

The current climate forces us to the base, with a focus on solidifying the exposed areas that may have been made apparent, and likely compounded, by the current realities. Concerns on management, metrics, core values, and priorities serve as the bases in need of coverage.

Maslow’s Hierarchy of Needs

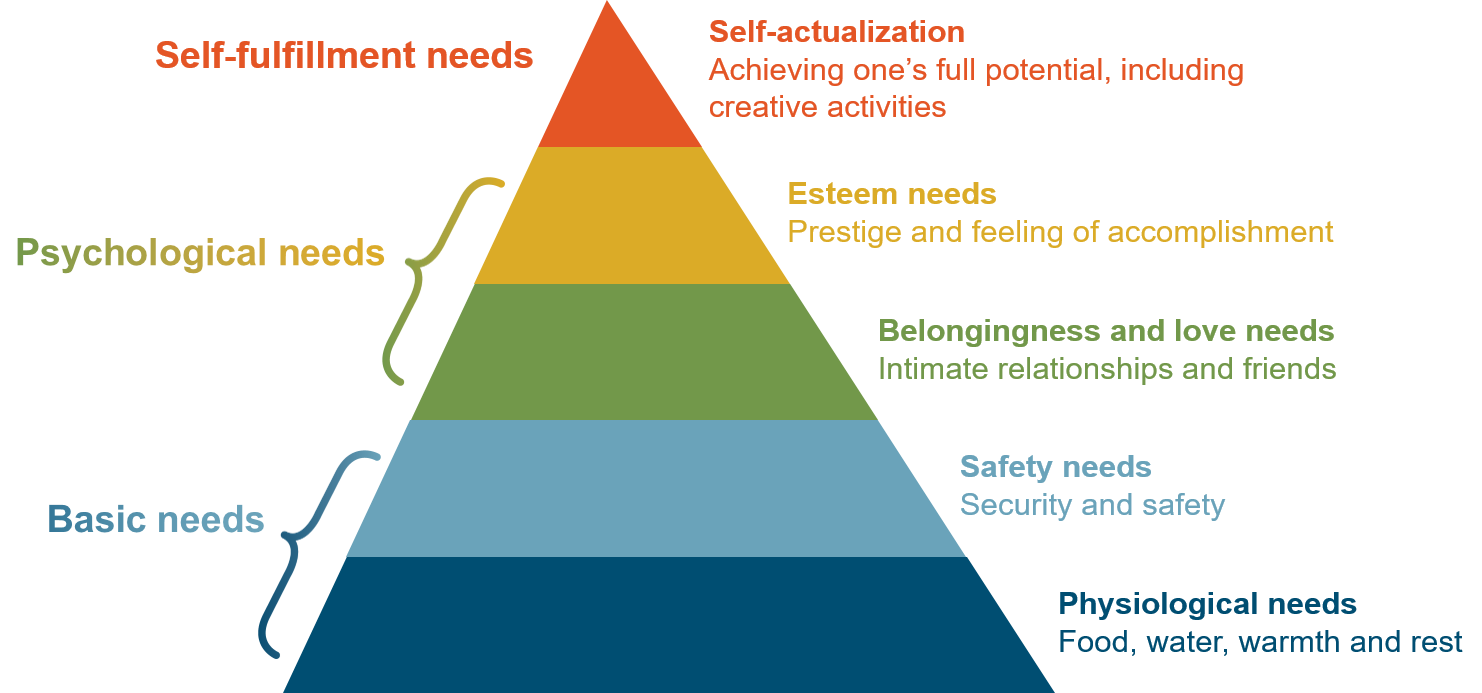

Maslow’s Hierarchy of Needs1 is a well-known motivational theory in psychology that comprises a five-tiered model of human needs, whereby each successive tier must be fulfilled (beginning at the base) before rising to the next tier. It can be used to view similar information from a psychological perspective.

Value acceleration and creating successful outcomes are largely tied to a clear long-term vision. We typically reside in the Self-actualization level of the hierarchy of needs when undertaking the high-level view of the framework.

Based on the adaptability and call for sudden directional changes in today’s climate, we are not as concerned with these top levels. We have them in our back pocket for easy recall, but they are not the pressing issue staring us in the face.

If we think about shoring up bases (the Protect Stage), in considering this psychological model, our focus is on the “basic needs” level. That is, keeping people (self, family, and employees) safe and remaining connected for immediate continuity.

McKinsey & Company Event Horizons

.png)

However, once these bases have been clearly assessed and addressed, the path forward may appear dramatically different, in which case creative solutions to enhance opportunity should begin to form. Examples of this may include newly emerged revenue streams and opportunity areas, fully integrated systems and dashboards to capture timely decision making data points, or pivots in your business model adaptable and reactive to new environments.

One example that has been in the news recently involves CEOs being pleasantly surprised that productivity of employees has not dropped even though people are working from home. How sustainable is this productivity? What implications might this have for corporate real estate and office settings? The answers will vary widely, depending on your business and competitive environment.

Exposure, discover, and control

Back to our tides analogy for a moment. As the water receded, what new rocks were exposed or what existing challenges became more apparent? What is your plan to address these areas? Is this the time to make large investments in your company or the right investments? Now that the tide is out, it is time to shore up, move the rocks, and address elements of your business to prepare for long-term successes. Through our assessments, risk profiling, and benchmarking analyses, we help business owners discover the largest gaps across the company, prioritize the most impactful problem areas to address, and implement changes to enhance business value through continuous improvement.

Taking stock of your company’s future through the incorporation of lessons learned will bolster value in the long-term by de-risking and developing new opportunities, methods, work, shifts in productivity, and shifts in mentality. That approach also brings lots of questions: If there are no early warning signs, why not? What should your indicators be? What metrics are crucial in identifying the pulse of your current situation? What is your business reliant on? How can you build information and indicators for rapid shifts in decision making? How strong are your current controls and how integrated are your management and information systems?

To answer these questions, you need to quantify and develop metrics that will aid in the early identification of future challenges, thus increasing your responsiveness with data-driven decision mechanisms. Having your fingers on the pulse of your company and understanding the impact of each input to your strategy will focus your attention on the information that matters most. This allows you to understand, position, and adapt to changes in your business and community environment in a proactive and agile manner. Measurements, forecasts, and dashboards should provide you with regular, valid, and relevant information you can use to take informed action in decision making.

Historical look backs during various points of time will allow you to key in on pivotal data indicators and inflection points. When looking at this from an operational view, industry and economic factors impacting your company can serve as corroborating pieces of evidence to further support data metrics analyzed.

As you perform look backs, it is also best practice to regularly study and update development, pipeline, and reliance metrics for feedback and information discovery with data integrated throughout your operations. This helps avoid lag time in reporting on stale information towards real-time actionable data points.

Each metric is specific to your business and can be directly mapped back to increases in shareholder value. Understanding these drivers of business value will focus your attention and intention on improving in the right areas, while avoiding distracting and less impactful pain points.

Don’t fret over precision, rather build in flexibility and adaptability with scenario- and sensitivity-based criterion to understand changes, implications, and reliance of each input. Understanding these relationships in a broader scheme aid you in quick, impactful decision making guiding you towards enhanced value.

Resilience until the tides rise

This approach allows opportunity to fully assess the known and unknown problem areas, weaknesses, perils, and hazards your business may be facing. From that base you can begin to address these issues to scale effectively with lower overall risk when activity picks up.

Management metrics, core values, and priorities drive resilience for long-term continuity by shoring up the foundation to build for the future. Assembling evidence in troubled times provides opportunity to capitalize on and fulfill core values. Documenting these decisions and improvements memorialize your decision making, impact on value enhancement, and should serve as a playbook for future events.

What you make of the time you have now through identification, assessment, and addressing newly emerged risk areas provides the opportunity to increase success once the economy rebounds. We are here to help. If you have questions about your particular situation, or would like more information, please contact the business valuation consulting team.

1Maslow’s Hierarchy of Needs, Saul McLeod, updated March 20, 2020. SimplyPsychology. www.simplypsychology.org/maslow.html.

2Beyond coronavirus: The path to the next normal, Kevin Sneader and Shubham Singhal, McKinsey & Company, March 23, 2020. www.mckinsey.com/industries/healthcare-systems-and-services/our-insights/beyond-coronavirus-the-path-to-the-next-normal. COVID-19: Briefing note, March 30, 2020, Our latest perspectives on the coronavirus pandemic. Matt Craven, Mihir Mysore, Shubham Singhal, Sven Smit, and Matt Wilson. McKinsey & Company. www.mckinsey.com/business-functions/risk/our-insights/covid-19-implications-for-business.