The end of 4Q 2024 marks the start of a new year. In the Valuation Group, the end of the calendar year brings us to one of our busiest times of year: “ESOP season.” During the first few months of the year, we perform annual valuations for 30+ ESOP clients.

Meanwhile, other members of the valuation team have been focusing on assisting business owners with exit planning through our value acceleration service. The value acceleration exit planning framework is designed to help business owners identify and address value constraints and transferability limitations, but like turning a ship, it takes time. We recommend that business owners understand their strengths, limitations, and value at least five years before planning to exit. This proactive approach allows for a smoother transition and maximizes the business’ value.

Often, business owners like to wait until year-end results come out to make decisions. That way, they can compare performance year-over-year to aid in decision-making. Now that 2024 has concluded, we can assist business owners with decision-making by determining the value of the business based on year-end results. The end of the year is a busy time, with fiscal years wrapping up and holidays in full swing. As we move into 2025, it's an opportune moment to make strategic decisions for the future.

Speaking of busy, M&A activity often peaks in the fourth quarter. In 2024, this trend was again observable. After a strong year in 2024, our transaction advisory team is looking to help more clients sell or buy companies in 2025.

Another exciting opportunity for BerryDunn’s valuations team is the merger of BerryDunn and Burzenski & Company on December 1, 2024. Burzenski is well known for its work with veterinary practices and the construction industry. The merger will enable BerryDunn to expand into the veterinary practice market and add to its existing construction practice.

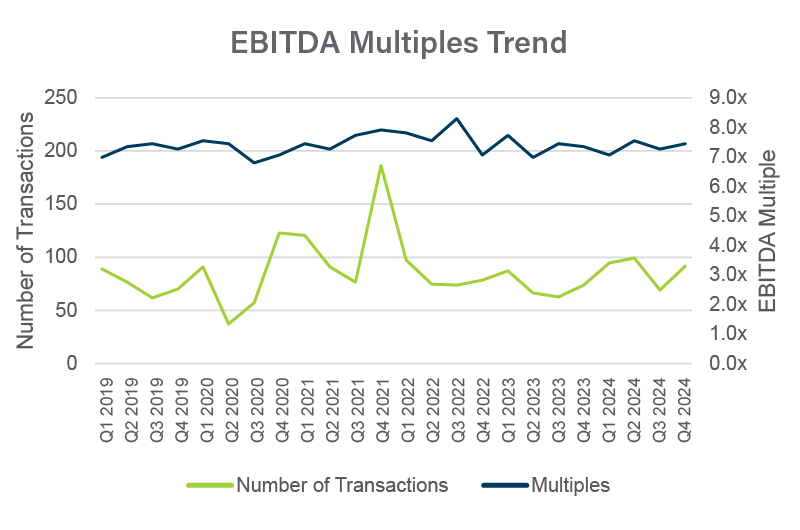

We track trends in several databases of private company transactions, among them GF Data, Capital IQ, DealStats, and BIZCOMPS. As presented below, we saw a slight downturn in multiples in the third quarter of 2024. We also saw the number of transactions increase in the fourth quarter compared to the third quarter of 2024 and in line with the first and second quarter.

Don’t get too fixated on the multiples in this chart as an indicator of value for your company. Look at the trends. Multiples vary dramatically from industry to industry and business to business. If you are interested in exploring value drivers for your company, read this recent article.

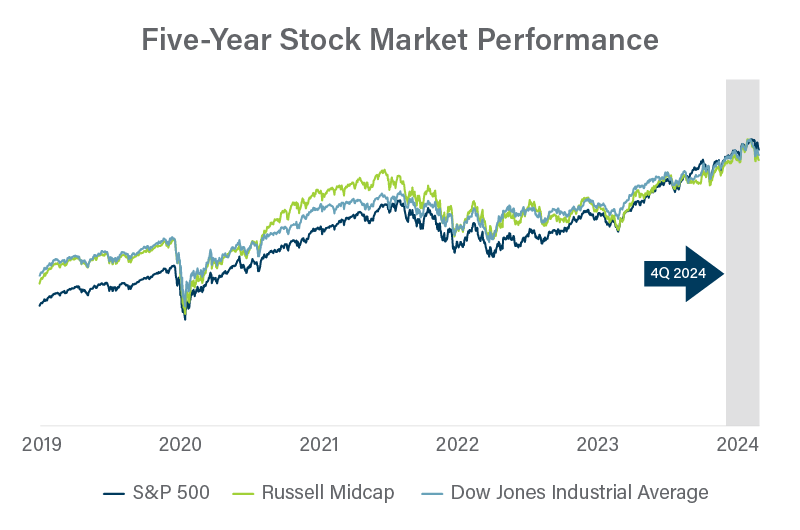

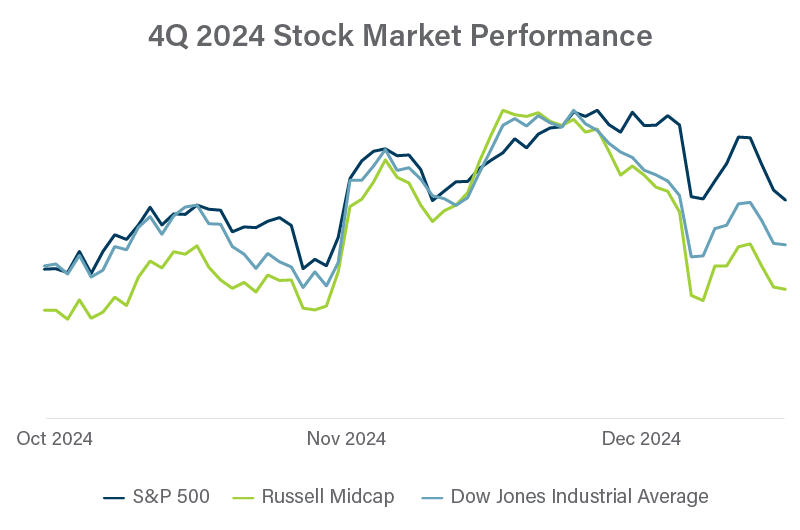

The value of privately held companies often isn’t as volatile as share prices for public companies. However, activity in the stock market provides general guidance that is often much more timely than data available for private companies.

There are a few indexes we keep an eye on. The S&P 500 is generally considered the go-to benchmark for stock market performance, although it is dominated by a handful of large tech stocks. The Russell Midcap Index cuts out the largest 200 companies in the Russell 1000 Index, keeping 800 US companies with market capitalizations between $2 billion and $10 billion. The Dow Jones Industrial Average is comprised of 30 “blue chip” US stocks that may be similar to many private companies.

Stock prices have followed a generally upward trend throughout 2024 but have started to trend downward toward the end of Q4.

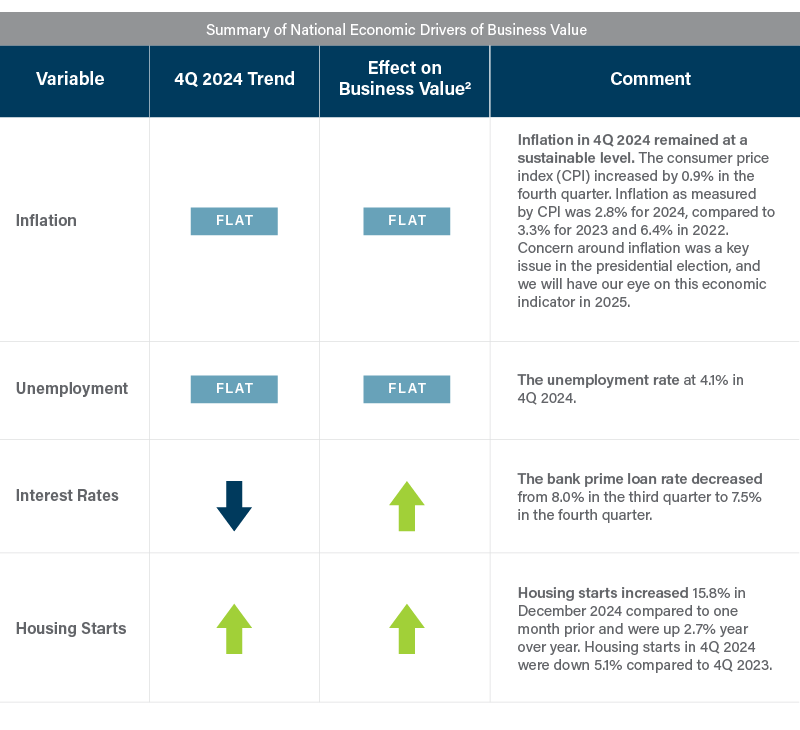

Many drivers of business value can be influenced or controlled by the decisions of the business’s management team, including product diversification, brand recognition, and employee retention. Other drivers are outside of management’s control, such as inflation and unemployment rates. As summarized below, key drivers of the US economy generally remained near similar levels in 4Q as in 3Q.1

1 Source: Federal Reserve Economic Data, available at https://fred.stlouisfed.org/.

2 Indicates the likely effect on business value for most businesses. Depending on the business model, certain businesses may demonstrate an inverse relationship to economic variables compared to the market as a whole.

As many of our clients are located in New England, we’ve included a summary below of some of the key economic drivers that affect businesses in the Northeast3. If your business is headquartered outside of New England, reach out to us for an economic analysis specific to your market area.

Economic activity

Economic activity increased slightly overall. Prices and employment levels were roughly unchanged, and wages rose at a modest pace. Air travel was a relative bright spot, as domestic air passenger traffic through Boston finally surpassed 2019 levels, and passenger traffic through the Worcester airport increased substantially in the past year. Tourism activity overall increased only modestly, however, and restaurants in some areas reported softer-than-expected sales. Retail revenues rose slightly, and consumers remained highly price-conscious. Manufacturing sales were mixed, while software and IT services firms experienced stable and healthy demand. Residential real estate sales increased modestly, helped by improved inventories in some areas, while commercial real estate activity was flat. The outlook was modestly optimistic on balance, although some contacts had concerns for 2025 related to how national economic policies might change and where long-term interest rates would land.

Labor markets

Employment was roughly steady, and wages increased modestly on average. Contacts in the retail, tourism, and software and IT services sectors all reported stable headcounts. Among manufacturing contacts, headcounts increased slightly at selected firms, decreased modestly at one in response to slower sales, and were reportedly unchanged otherwise. Labor supply to retail and tourism jobs improved modestly, with contacts noting greater ease of hiring and reduced attrition. Wages increased modestly on average, and contacts reported no elevated wage pressures. However, one manufacturing contact experienced a significant increase in health insurance costs that they partly passed on to employees, while offering a slight wage increase as an incomplete offset. No contacts mentioned plans for major changes in hiring or wages in 2025. Cape Cod contacts, whose businesses rely heavily on seasonal worker visas, expressed concerns that potential changes to visa programs could restrict their labor supply in 2025 or beyond.

Prices

Prices were about flat on balance. An online retailer reported only modest pricing pressures and remained keenly aware of consumers’ heightened price sensitivity. The same contact was cautiously optimistic that any tariffs would not have a major impact on their prices, owing to changes made to their supply chain in recent years. Hotel room rates in the Greater Boston area decreased modestly on a year-over-year basis, but contacts pointed out that the change was in relation to the record-high room prices of November 2023. Manufacturers held output prices steady, even though most experienced slight to modest increases in input prices. Software and IT services firms posted modest price increases on average. Contacts did not foresee major changes in pricing pressures for their businesses moving forward.

Retail and tourism

First District4 retail contacts reported slight increases in revenues in recent months, while tourism activity experienced modest growth on average. An online retailer described fourth-quarter revenues as stable overall but said that promotions had been critical to those results and that demand for lower-end goods remained weak. On Cape Cod in the fourth quarter, hotel occupancy rates and retail sales met expectations and were roughly on par with the fourth quarter of 2023, but restaurants experienced weaker-than-expected sales. Airline passenger traffic through Boston increased moderately in the fourth quarter from one year earlier, with domestic travel finally surpassing 2019 levels. Worcester air passenger counts grew 18 percent from the previous year. Like the change in hotel room prices, hotel occupancy rates in greater Boston were down slightly in November from one year earlier, when occupancy rates had been at all-time highs. Contacts expected robust tourism and convention activity for Boston for 2025. The outlook for retail and restaurant activity was more cautious, as contacts in those businesses expected roughly flat activity going forward.

Manufacturing and related services

Manufacturing sales were flat on average since the last report. Most firms reported no change in revenues in the fourth quarter from the third, but sales were unexpectedly soft for one manufacturer and unexpectedly strong for another. The strong sales pertained to a frozen fish producer who speculated that retailers were accumulating inventories in anticipation of tariffs. A semiconductor maker with flat sales said that demand for their products was softening and that they would adjust employment downward moving forward. Capital expenditures largely stayed within forecast ranges. The outlook for 2025 was modestly positive on balance, as most firms expected sales to increase at least slightly in the new year, but one semiconductor manufacturer expected moderate declines in sales relative to 2024.

IT and software services

First District IT and software services contacts described demand as stable at healthy levels, and one firm’s total revenues for 2024 exceeded expectations. Capital spending was constant, and physical investments were described as minimal given firms’ reliance on cloud computing services. Contacts expected revenues to increase strongly in the first quarter of 2025, based on a combination of organic growth in demand and, in one case, the recent acquisition of another company. Considering the longer-term outlook, most contacts expressed confidence that demand for their products would continue to rise, even in an environment of heightened political and macroeconomic uncertainty. Nonetheless, one firm said that increased competition from China affecting its clients could either boost its business, as client firms invested in new technologies to keep up, or hurt demand if clients were pushed out of the market altogether by such competition.

Commercial real estate

Commercial real estate activity was mostly flat in the First District. Contacts reported uniformly that elevated long-term interest rates continued to limit transactions. One contact said that borrowers, hoping that long-term rates would decline, continued to favor extensions for maturing loans. However, several contacts downgraded the chances of significant rate declines in 2025. Office leasing activity remained slow, but prime Boston properties continued to experience relatively healthy activity. Contacts described industrial and retail leasing activity as stable. Rents and occupancy rates were unchanged across all asset classes. One contact said that a recent Massachusetts law intended to promote multifamily construction was yielding tangible results in some areas of the state. Around half of contacts were cautiously optimistic that the first quarter of 2025 would bring more robust commercial real estate activity, while others expected current activity levels to persist or, more pessimistically, that interest rates would stay higher for longer than previously expected and exert negative impacts on the market.

Residential real estate

Home sales in the First District rose modestly on a year-over-year basis in November 2024, the most recent month for which data was available. Supporting the increase in sales, home inventories were up moderately from a year ago overall, with very large increases in Maine and Vermont, although inventories declined moderately in Massachusetts from a year earlier. However, the typical number of days homes spent on the market increased, as multiple contacts mentioned that some buyers were waiting until after the presidential election to make purchasing decisions. Considering changes since November 2023, prices of single-family homes increased at a brisk pace, while condo prices increased moderately on average in Massachusetts and Rhode Island but decreased modestly in the northern New England states. Multiple contacts expressed optimism that more sellers would put their homes on the market in early 2025 and that this would lead to increased sales activity.

3 Quoted from the Beige Book – January 2025 from the Board of Governors of the Federal Reserve System.

4 The Federal Reserve System’s First District includes Connecticut (excluding Fairfield County), Massachusetts, Maine, New Hampshire, Rhode Island, and Vermont.

Where to find us

Casey Karlsen and Seth Webber are leading a four-part workshop series for business owners about increasing business value and liquidity. We previously summarized this content in a couple of blog posts (Session 1, Session 2, Session 3). Take a look if you missed us!

Interested in meeting the team? Please reach out to us. We would love to connect.