Read this if you are looking to buy or sell a construction company.

This article was previously published in Construction Accounting and Taxation, January/February 2022 ©2022 Thomson Reuters/Tax & Accounting.

The other day, my wife was telling me about her dad’s friend who used to be a daredevil backcountry skier. He loved cliff drops and had a reckless approach, once quipping, “I’ll find a landing spot on the way down.”

Our valuation team includes several expert skiers and snowboarders, but we have little in common with this approach. When we ski, we carefully assess the risks before taking action. Because we spent all day assessing risk, we’re far more likely to take a scouting run and develop a couple of alternatives. Even in our wildest days, we would never go off cliffs without first investigating the landing.

The same approach should be used when acquiring a business. Acquiring a business can be a big financial risk, possibly the biggest financial risk of one’s life. It might even feel like skiing off a cliff. We frequently work with clients that are acquiring businesses, and we recommend a strategy of investigation and analysis, carefully vetting potential acquisitions, before taking action.

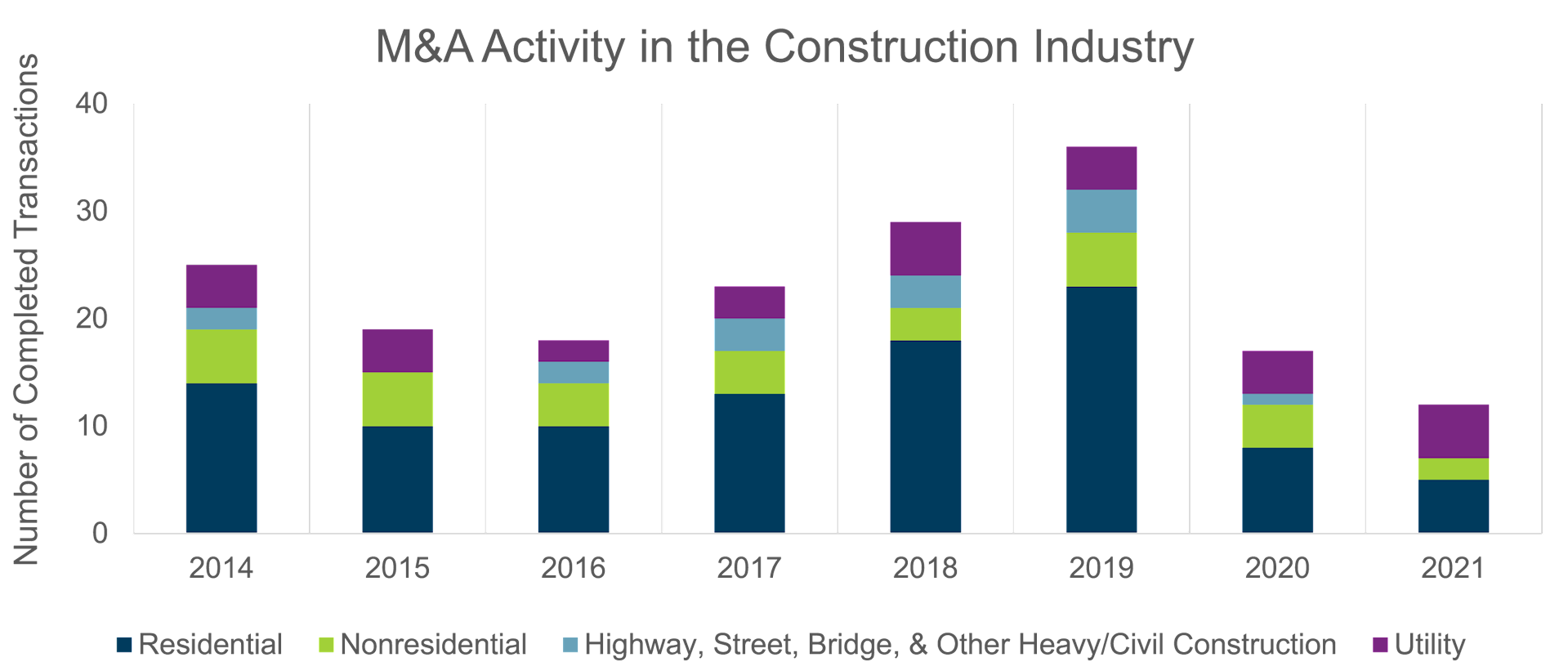

Recent M&A activity

The pandemic caused a drop-off in merger and acquisition (M&A) activity as many companies were focused on the challenges immediately at hand. As shown in the accompanying chart, the sale of construction companies reported in the DealStats database1 dropped by approximately 53% in 2020.

As the business environment settles down to the “new normal,” M&A activity will likely begin to pick up again. An opportunity created by the pandemic is the opportunity to acquire struggling companies at a discount. Some companies are unable (or unwilling) to adapt to the new business environment and its many challenges. This fact pattern may represent an opportunity for stabilized companies to expand through acquisition.

There are numerous other reasons to acquire a business. One common reason historically is to expand into a new service area. For example, one of our clients wanted to expand into concrete services, so they acquired a concrete contractor rather than developing those skills in-house. Another residential builder decided to eliminate a bottleneck in the building process by acquiring a roofing contractor.

Particularly in the current tight labor market, we have observed numerous “acquihires” where the primary motivation for a deal is to secure a key person or team of employees – particularly for in-demand specialty subcontractors.

Companies also use acquisitions as an opportunity to establish a new geographical footprint. This strategy is especially useful when ties to the community are important in the business development process. The motivation for an acquisition might also be access to a particular client or access to a new niche.

Growing through acquisition can enable companies to achieve economies of scale and synergistic benefits through elimination of redundancies. Acquiring a competitor may also yield a secondary benefit by eliminating a source of competition.

All of these opportunities may paint an overoptimistic picture of the benefits of mergers and acquisitions. According to Harvard Business Review, approximately 70% to 90% of acquisitions fail to realize their targeted outcomes.2 There are a myriad of factors that can cause acquisitions to go awry. Keep the following tips in mind that we have learned from our experience working with companies that completed a successful acquisition.

Tip #1: Avoid being rushed

Acquiring a business is a big decision that will change the trajectory of the acquirer. If one is rushed into a decision, it is easier to miss key pieces of information. If there is not enough time to learn about the business model and make a careful decision, pass on the acquisition. There will always be future opportunities.

Tip #2: Perform rigorous financial due diligence

Two primary factors drive business value: income and risk. Financial due diligence is the process of verifying income and assessing risk. We recommend having a financial due diligence checklist as an organized method to analyze a company that one is acquiring. By following this checklist, one can learn about a company’s income, assets, liabilities, contracts, benefits, and potential problems (customer concentration, claims and litigation issues, management bench strength, etc.). To perform adequate due diligence, request thorough documentation and dig deep.

We once helped an individual out who was considering acquiring a business that had very limited financial information available. The seller painted a glowing picture of profitability but lacked the financial data to back the claims. With a significant investment on the line, the potential acquirer judiciously passed on this opportunity. He felt that it wasn’t prudent to rely on the word of a stranger in the absence of data. In order to make a good buying decision, require sellers to bring data to the table. Be skeptical. In one of our former careers in engineering, there was a common mantra – in God we trust, everyone else brings data. If it sounds too good to be true, it probably is.

As part of the financial due diligence, review financial statements for at least the last five years. Audited financial statements are preferred. Additionally, request monthly contract schedules showing completed contracts and work-in-progress (WIP). Monthly contract schedules can provide information about the timing of projects, margins over time, information about change orders, billing practices, and the cadence of work for a particular company.

Success in the construction industry hinges on cash management. Construction firms need to bid contracts and manage operations such that they collect payment as soon as possible in order to avoid a liquidity crisis. A positive indicator is the presence of contract liabilities, which represent billings from customers in excess of revenue recognized to date. This “good liability” indicates that project managers are attentive and understand the business aspect of their roles and/or that company has well written contacts allowing them to bill advantageously. In combination with strong cash flows from operations and good working capital metrics, a contract liability in excess of any contract asset is a good indicator of a strong cash management position.

On the other hand, the alternative is a contract asset. Contract assets, which are often characterized as “bad assets,” represent revenue recognized in excess of amounts billed. In other words, the company does not have an unconditional right to payment. This could be due to poor contract writing, inattention to scope-creep, difficulty negotiating change orders with clients, or just bad billing practices. Contract assets may also be generated in a manner that does not raise concern. For example, a company might work primarily with government entities and therefore be restricted in their ability to pre-bill. In any case, if contract assets are consistent and substantial, one should inquire into what is giving rise to this asset.

In the event that contract assets are generated through poor business practices, an acquirer may be able to implement their own billing practices to improve the target’s position, but existing poorly written contracts could pose a large liability and claim on cash flow post-merger.

Tip #3: Analyze key relationships

A valuable component of intangible value is customer relationships. The most valuable customer base is one that is diversified and stable, ideally with contracts in place. Before acquiring a company, assess the risk associated with its customer base by analyzing concentration and the tenure of relationships with key customers. In some cases, customer reviews may also be available through Google and other platforms.

Relationships with surety and bonding companies as well as subcontractors should also be topics in due diligence.

Tip #4: Learn about the employees

Many businesses rightly state, “Our employees are our most valuable asset.” What if this valuable asset becomes disgruntled and walks away after a transaction? We recommend probing employee turnover and satisfaction, as well as analyzing employment contracts. External resources may also be available, or discussions with key customers and subcontractors can be revealing.

Oftentimes, post-merger integration is unsuccessful due to differences in the cultures between the acquirer and the target. During the due diligence process, learn about the target’s culture and consider how it will likely integrate with your company’s existing culture.

Tip #5: Assess key person dependence

Many companies cannot operate without the current owner in the driver’s seat. Many key processes, business development in particular, run through this individual. Develop an understanding of what would happen to the business without this person’s involvement. The individual in question (the “key person”) might not be the owner, but a key employee that is essential to business operations. Key person dependence represents a threat to the company in the event of the employee’s departure from the company or incapacitation.

Some questions we often ask to identify and assess key person dependence include the following:

- Who is responsible for business development?

- How important are individual relationships to the development of new work?

- Do people become customers because of the reputation of the company or the reputation of an individual?

- Has management began training up the next level of management beneath them?

- Do any employees have any specialized knowledge or skills that no other employees have that would be difficult to replace?

- What would happen to the company if a key employee won the lottery and never came into work again?

Tip #6: Have the seller stick around

Business owners are steeped in the knowledge of their business. This know-how may take time to transfer. Signing the seller to an employment agreement and/or earn-out as part of the transaction can provide the acquirer critical time to absorb the seller’s expertise.

Tip #7: Don’t assume the good times will last forever

Many construction companies have reported strong profitability despite the pandemic. These profits may simply reflect recent economic trends rather than strong business models. If, or when, the economy takes another drop, many businesses will follow suit. Will the business being purchased survive in a difficult economic climate? To answer this question, consider the following strategies.

First, study how they performed in the last economic recession, keeping in mind the rule of thumb that construction industry downturns generally lag two years behind the rest of the economy and last twice as long. Second, compare a company’s growth and profitability to its industry to reveal whether it is a star or simply rising with the tide. In the words of Warren Buffett, “It’s only when the tide goes out that you learn who’s been swimming naked.” Third, study the business model to link their business drivers to economic factors.

Tip #8: Consider tax and legal consequences

Many people focus their time and energy negotiating the transaction price and disregard the transaction structure. The amount of taxes paid may increase or decrease dramatically based on the transaction structure. However, tax consequences are often given less attention because they are frustrating and complicated. By spending a little extra time on the transaction structure, acquirers can optimize their after-tax sale proceeds.

Different deal structures may also sever existing liability or create nightmares in the future. Be sure to discuss these with your legal counsel and weigh the potential risks and returns of structure.

Tip #9: Get different perspectives

Discuss the opportunity with trusted friends, families, and mentors. Bringing in different perspectives can cast light on elements that would otherwise have gone unnoticed.

Bring in professional perspectives as well for tax, legal, and financial items. Contact a professional regarding the purchase price. Businesses are tricky to value. Two people can have disparate opinions about what it is worth. A business valuation can ground the expectations on price and provide a framework to keep “deal emotions” in check. A business valuation could save a considerable amount of money and time.

We offer this word of caution: avoid blindly relying on the perspectives of others. Bring them in as counsel, but make sure to have a firm understanding of the offered terms and the business model yourself. Think critically about the decision to buy or walk away as the choice is yours to make.

Conclusion

In both skiing and acquiring a business, we recommend taking calculated risks. Acquiring a business is a big decision and should be taken seriously. There are many benefits to M&A activity, including expanding services offerings, geographical footprint, employee base, and ultimately profitability. In order to ensure the full benefits of a successful acquisition, keep in mind the advice in this discussion when considering acquiring a company.

1DealStats is a subscription-based database of business transactions available online at www.bvresources.com/.

2“The Big Idea: The New M&A Playbook” by Clayton M. Christensen, Richard Alton, Curtis Rising, and Andrew Waldeck. Harvard Business Review, March 2011. Accessed online at https://hbr.org/2011/03/the-big-idea-the-new-ma-playbook.