Prepare for a secure next chapter, for you and your business.

You worked hard. You built a successful, privately owned business. Now it is time to reap the rewards of that hard work, while leaving your business in great shape for the future.

Our extensive business succession knowledge helps you gain control of opportunities, make informed decisions, extract liquidity from your business, realize an enhanced business value, minimize taxes, and enter the next stage of your life on your terms.

An exit strategy is not the same as selling your business. There are many options for you to consider as you transition from your business and realize the value you’ve created. Our custom-tailored guidance can help you plan an exit that makes sense for you, your family, employees, and the business. We help you establish exit goals, measure financial readiness, choose the optimal exit option, and execute a succession plan to achieve your goals.

Our succession planning process helps you:

- Measure your financial readiness – meet your post-exit needs

- Exit on your timeline – prepare to leave when the time is right

- Clarify expectations – understand how much you will receive post transfer

- Transition leadership – fill key roles to sustain the business after you leave

- Maximize sale proceeds – maximize your value with business valuation services

- Minimize taxes – understand the tax impacts of your exit strategy

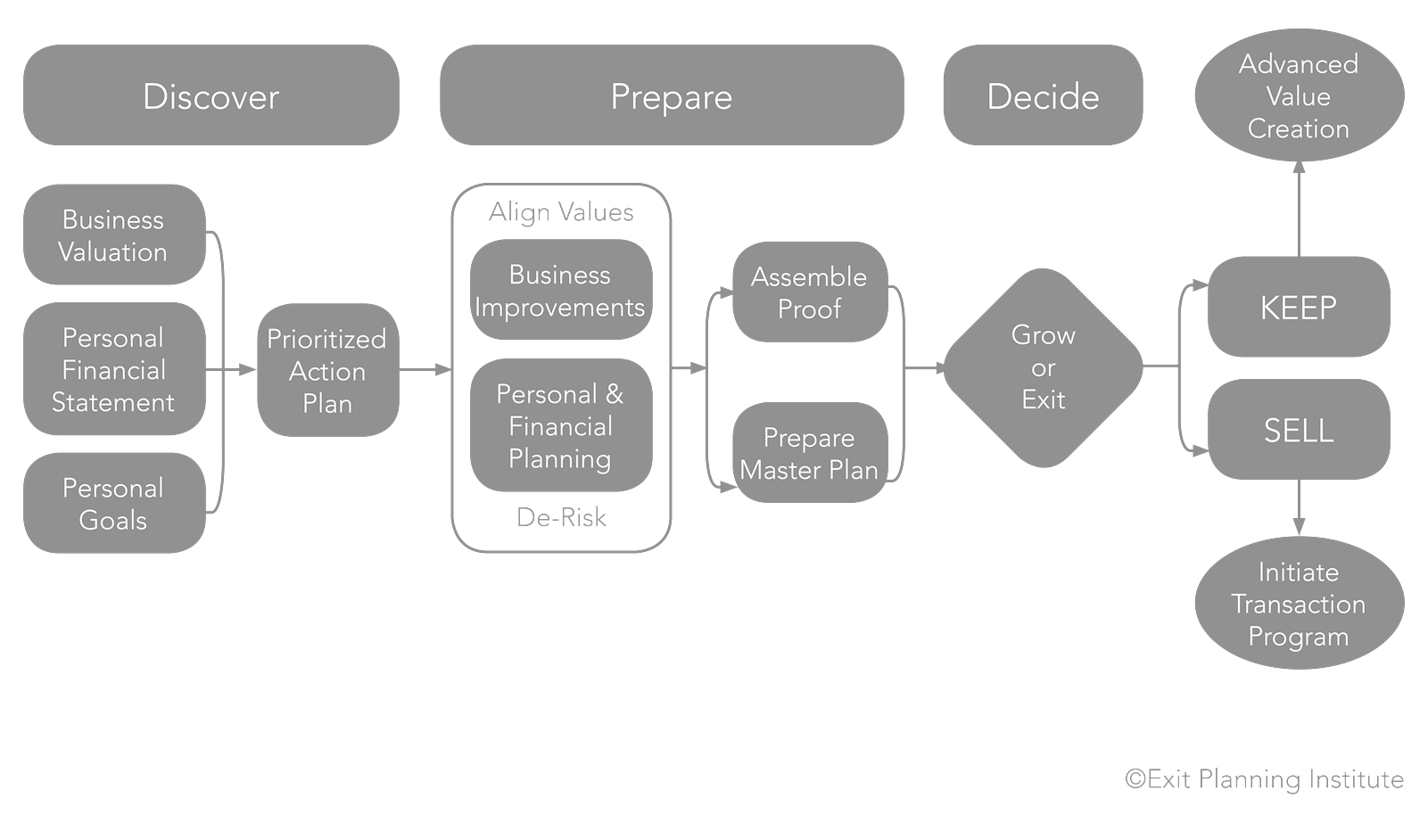

As Certified Exit Planning Advisors, we help to identify, protect, build, harvest, and manage wealth to assist business owners and their families through an ownership transition. We are a part of the Exit Planning Institute’s international community of CEPAs. Using our value acceleration methodology, we help business owners build value into their businesses and liquidity into their lives. Learn more about our process below, or contact a member of the succession planning team.

While nearly all business owners agree having a transition strategy is important for both their future and the future of their businesses, most have undertaken limited planning processes. Of business owners:

- 78% expect to fund 80% or more of their retirement through the sale of their business. However, nearly 80% of businesses put on the market don’t sell.

- 75% surveyed “profoundly regretted” the decision just 12 months after selling

- 67% do not know all of their exit options

- 86% have not completed a strategic review or a value growth project

- 78% have no transition team, 83% have no written transition plan, and 49% have no plan at all

We can help you:

- Discover – take inventory of your personal, financial, and business goals

- Prepare – follow through on business improvement and personal and financial planning action items identified in the Discover stage

- Decide – whether to grow your business or exit, and which business liquidity options are available for each path