The Federal Deposit Insurance Corporation (FDIC) recently issued its fourth quarter 2023 Quarterly Banking Profile. The report provides financial information based on Call Reports filed by 4,587 FDIC-insured commercial banks and savings institutions. The report also contains a section specific to community bank performance. In fourth quarter 2023, this section included the financial information of 4,140 FDIC-insured community banks. BerryDunn’s key takeaways from the report are as follows:

Community banks’ full year net income down $2 billion from 2022.

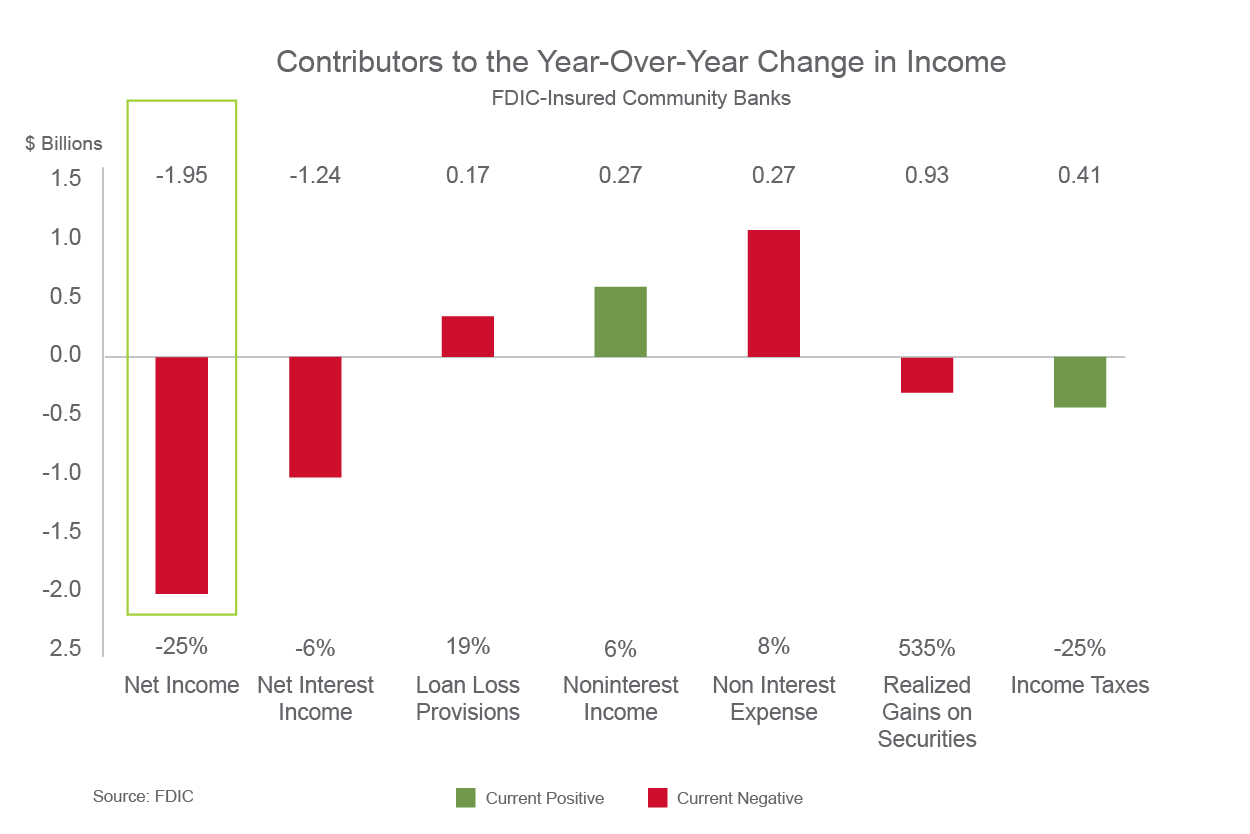

Full-year net income declined 7.1% in 2023 to $26.6 billion from $28.6 billion in 2022. Quarterly net income for community banks declined 9.9% in fourth quarter 2023, a $650.2 million decrease from the prior quarter resulting in $5.9 billion in quarterly net income. Compared to fourth quarter 2022, net income had decreased $1.9 billion, or 24.7%. More than half (59.7%) of all community banks reported a decline in net income compared to third quarter 2023. Net income for community banks was impacted by higher noninterest expense, lower noninterest income, and increased loan loss provisions.

Full-year net income declined 7.1% in 2023 to $26.6 billion from $28.6 billion in 2022. Quarterly net income for community banks declined 9.9% in fourth quarter 2023, a $650.2 million decrease from the prior quarter resulting in $5.9 billion in quarterly net income. Compared to fourth quarter 2022, net income had decreased $1.9 billion, or 24.7%. More than half (59.7%) of all community banks reported a decline in net income compared to third quarter 2023. Net income for community banks was impacted by higher noninterest expense, lower noninterest income, and increased loan loss provisions.

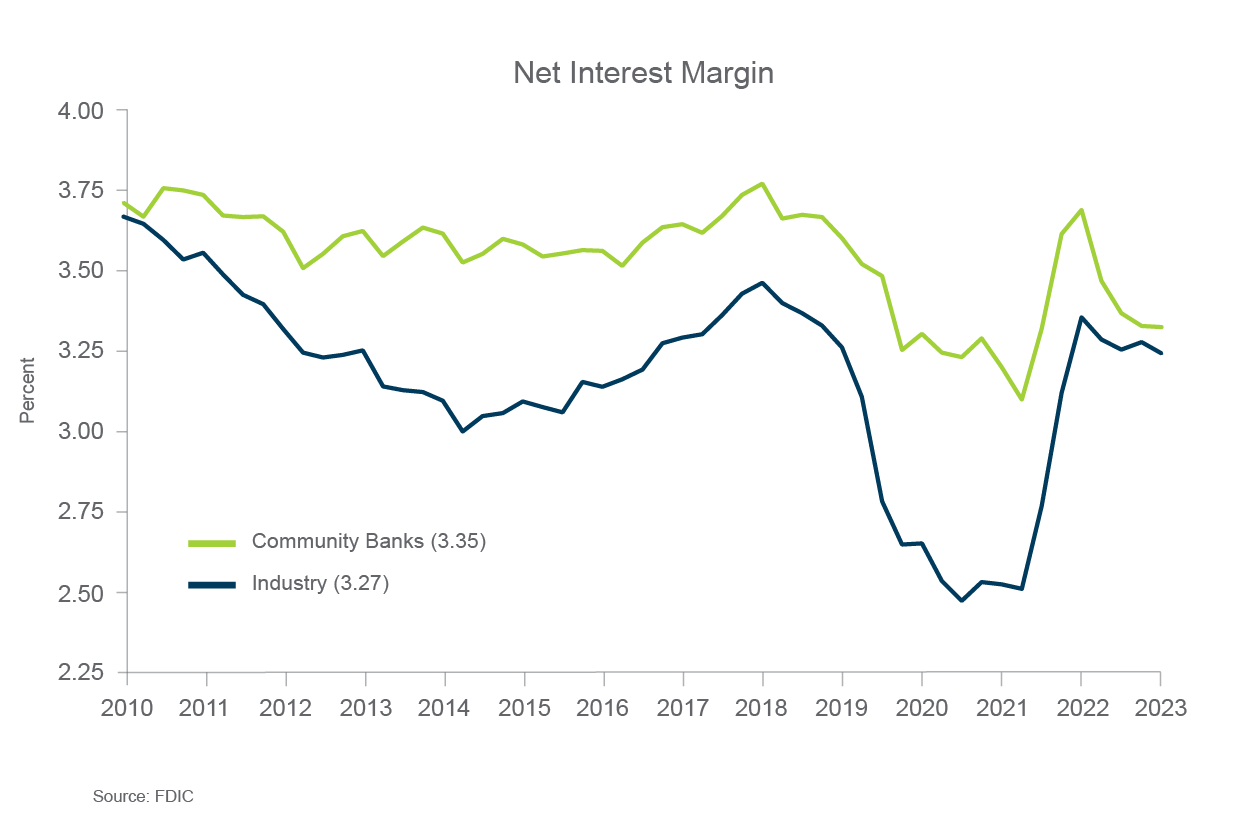

Community banks’ net interest margins (NIM) remain constant in the fourth quarter at 3.35%.

Despite remaining consistent quarter-over-quarter, NIM was down 36 basis points from the year-ago quarter. The yield on earning assets increased 88 basis points while the cost of funds increased 124 basis points. Despite the significant decline, the community banks’ NIM performance continued to prevail over the overall banking industry’s NIM of 3.28%, which declined three basis points in fourth quarter 2023. Despite the decline, the banking industry’s NIM remained three basis points above the pre-pandemic average NIM of 3.25%.

Loan and lease balances continued to grow in fourth quarter 2023, with 76.2% of community banks reporting quarterly loan growth.

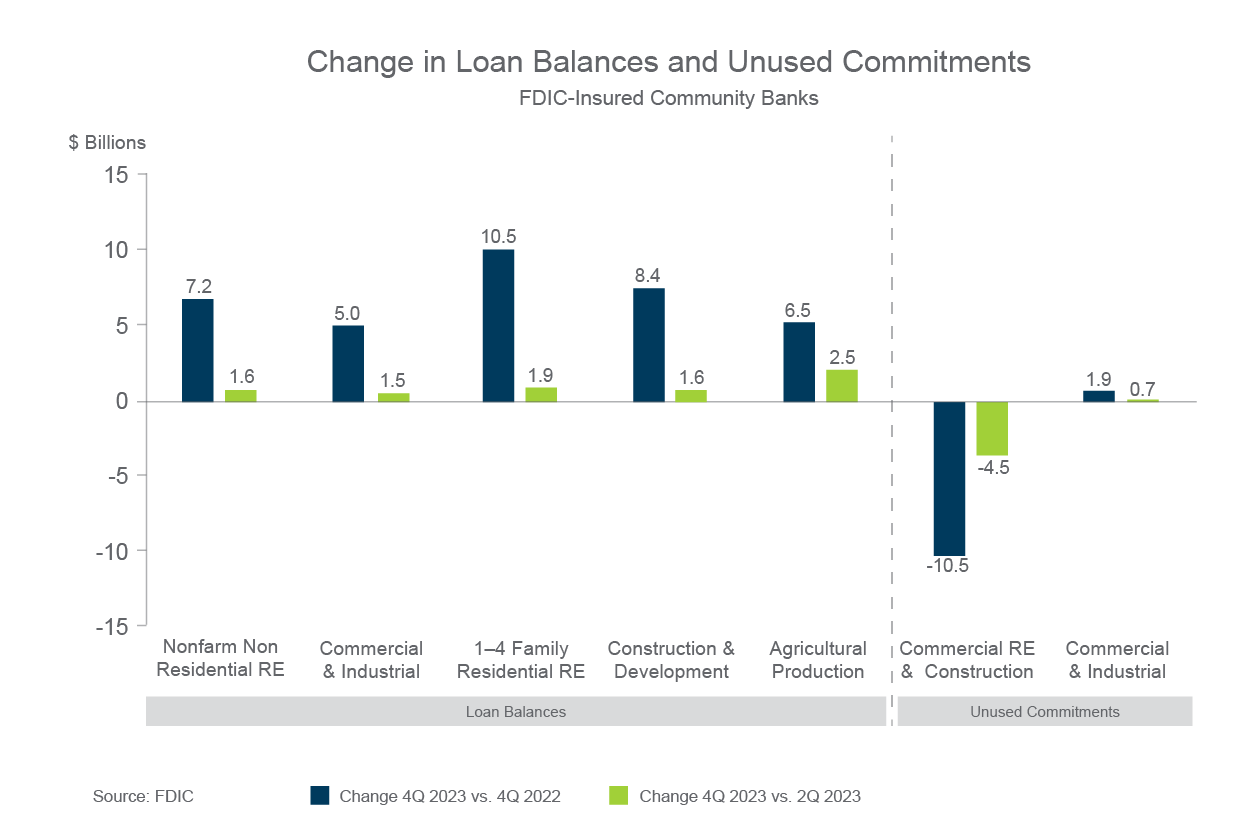

Loan and lease balances continued to see widespread growth in fourth quarter 2023. Community banks saw loan growth in all major portfolios. Residential real estate loans exhibited the most growth from the third quarter at 1.9%, followed closely by nonfarm, nonresidential CRE loans at 1.6%. Total loans and leases grew 7.9% from one year ago. This year-over-year growth was also driven by residential real estate and nonfarm, nonresidential CRE loans, which showed growth year-over-year of 10.1% and 7.2%, respectively.

Loan and lease balances continued to see widespread growth in fourth quarter 2023. Community banks saw loan growth in all major portfolios. Residential real estate loans exhibited the most growth from the third quarter at 1.9%, followed closely by nonfarm, nonresidential CRE loans at 1.6%. Total loans and leases grew 7.9% from one year ago. This year-over-year growth was also driven by residential real estate and nonfarm, nonresidential CRE loans, which showed growth year-over-year of 10.1% and 7.2%, respectively.

Community banking: When one door closes, another opens

With many calendar year-end institutions having wrapped up, or in the process of wrapping up year-end financial statement audits, it is starting to feel as if we can finally put a cap on 2023. What a year it was! Although the above analytics might not paint the rosiest of pictures, with full-year net income having slid 7.1%, there is still a lot to celebrate from 2023. On the financial side, loan demand continued to remain relatively strong, especially given the challenging rate environment, with loan balances having grown 7.9% from one year ago. Deposit balances, although not matching the growth in loans, also increased from one year ago, having increased 2.3%. Although inflation remained stubborn throughout 2023 and thus far through 2024, the prospects of a “soft landing” have grown for many, with unemployment remaining at historic lows. Recently, the Fed signaled they hope to cut interest rates three times in 2024, although this seems to be a moving target, given inflation’s persistence.

Let’s not forget, 2023 marked the year of adoption of the current expected credit loss (CECL) standard for many institutions. This is a monumental change for institutions, which completely overhauls the way institutions think about their allowance for loan losses. Not only did allowance calculations get completely revamped, many now relying significantly on vendors and peer data but as a result, processes, internal controls, and documentation also changed significantly from the previous incurred loss methodology. It is fitting for all of us to take a deep breath, as it feels as if we’ve all held our breath for the last few years leading up to adoption. We made it. Most of us are finally on the other side of an accounting standard that was issued seven years ago—and was partly a response to a crisis that occurred 15 years ago.

Although there may be future adjustments and iterations, the CECL standard is here to stay. So, once we take that deep breath, it’s time to dig back in and continue to refine and build upon the calculation and processes we’ve implemented in 2023. We’ve come to learn that, among other things, documentation is key under the CECL methodology, arguably more so than under the incurred loss methodology, and thus should continue to be a focus in 2024.

It may be hard to believe, but it’s been just over a year since the bank failures of March 2023. This was a scary time for the banking industry, as uncertainty set in as to whether your institution could be next. But, for many institutions, this event can be looked back on as a positive moment in 2023. This event brought the differences in banks, community vs. regional vs. global, to the spotlight, allowing community bankers to showcase their differences, highlighting how community-oriented your institutions really are.

So, with that, we give a salute to 2023 and look ahead to 2024. We’ve learned a lot and we have 2023, in part, to thank for that. If quarter one is any indication, we’re in for another rollercoaster of a ride in 2024. Artificial intelligence, including “Gen AI,” continues to dominate headlines, the Fed continues to humor the idea of cutting interest rates, and let’s not forget, 2024 is an election year. But what is a “normal” year anymore? If anything, the last few years have exemplified just how resilient the community banking space really is and have given us the tools and confidence to adapt to change in nearly real-time. In other words, bring it on, 2024. As always, BerryDunn’s Financial Services team will be right alongside you, navigating every rise, bump, and drop of this rollercoaster ride.