On June 21, 2018, the Financial Accounting Standards Board (FASB ) issued Accounting Standards Update (ASU) 2018-08, Clarifying the Scope and the Accounting Guidance for Contributions Received and Contributions Made. The ASU was issued to provide guidance to not-for-profit entities as they adopt ASU 2014-09, Revenue from Contracts with Customers, specifically as it relates to grants and contracts.

Why was clarification needed?

As stakeholders submitted comments on ASU 2014-09, it became clear that organizations were not able to easily determine whether certain donations, including grants received from State and Federal governments, should be categorized as “reciprocal or nonreciprocal” transactions. Additionally, when an organization categorizes a transaction as “nonreciprocal”, they must further determine if those donations are “conditional or unconditional”. The ambiguity surrounding these decision points resulted in disparity of practice among not-for-profit organizations.

ASU 2018-08 provides some clarity, helping not-for-profits distinguish how to account for certain grants and contributions. The guidance instructs that for:

- Reciprocal (exchange) transactions-organizations should follow guidance such as Accounting Standards Codification Topic No. 606, Revenue from Contracts with Customers.

- Nonreciprocal transactions (contributions)-organizations should follow guidance within Subtopic 958-605, Not-for-Profit Entities: Revenue Recognition

As not-for-profits analyze how to recognize certain donations/revenue sources, we outline some initial considerations in the following:

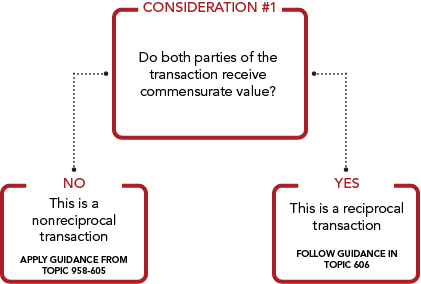

Consideration #1:

Reciprocal (exchange) transactions versus nonreciprocal (contributions)

Discussion:

Under current Generally Accepted Accounting Principles (GAAP), most organizations should account for grants and contracts from the government as exchange transactions, without consideration for commensurate value received. The new ASU clarifies that the benefit received by the general public is not the same as the resource provider receiving those benefits, i.e. there is no commensurate value in return. Therefore, not-for-profits should consider these types of transactions nonreciprocal under the new guidance.

If an organization determines that the transaction is reciprocal, they have completed the testing required and should follow the guidance in Topic 606. You can read our discussion regarding NFPs and the application of Topic 606 here. If they identify the transaction as nonreciprocal, the organization must complete consideration #2.

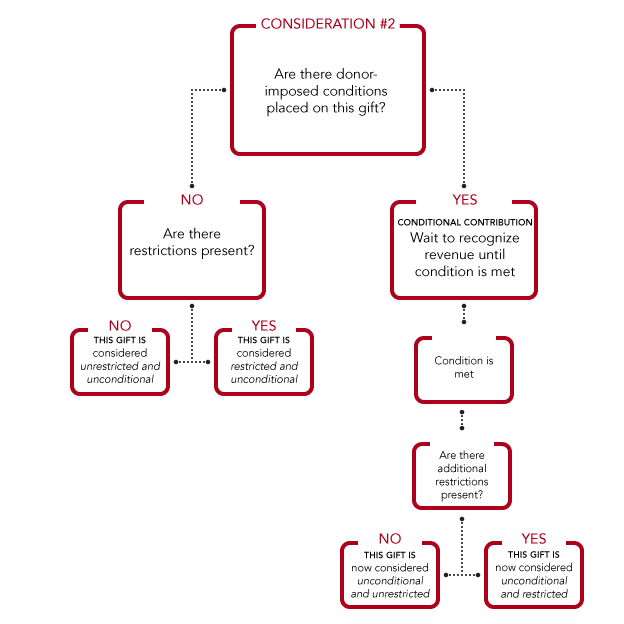

Consideration #2:

Conditional versus unconditional contributions

Discussion:

The ASU includes two factors to be used in the determination of whether or not a contribution is conditional:

- Is there a barrier that must be overcome (e.g., performance related measures, specific spending performance, or limited discretion on spending)?

- Is there a right of return/release included in the agreement?

The guidance on conditional versus unconditional is mostly unchanged from the current GAAP, however, under the new ASU, there are likely to be more grants and contracts being accounted for as a contribution, so the Update provides clarification between the two. Additionally, contribution revenue may be presented in the financial statements using many terms (grants, contracts, donations, or other). The Update simply provides guidance on how to record the underlying transaction.

What more do I need to know?

The effective date for recipients of grants and contracts:

- Public business entities, including NFPs that are conduit debt obligors – annual periods beginning after June 15, 2018, including interim periods

- All other entities – annual periods beginning after December 15, 2018, and interim periods beginning after December 15, 2019

The effective date for resource providers:

- Public business entities, including NFPs that are conduit debt obligors – annual periods beginning after December 15, 2018, including interim periods

- All other entities – annual periods beginning after December 15, 2019, and interim periods beginning after December 15, 2020

The Update should be adopted with a modified prospective approach. This applies to all agreements that exist at the effective date and entered into after the effective date. However, there is no need to restate amounts recognized prior to the adoption. Retrospective application of this Update is permitted.

Diagrams are based on:

Financial Accounting Foundation. Accounting Standards Update No. 2018-08, Not-for-Profit Entities (Topic 958). Connecticut: Financial Accounting Foundation, 2018, 19.